Posted 18 Dec 2010

Buying bitcoins using SEPA is done quickly and in bigger quantities compared to other methods. Below is a list of several bitcoin brokers and exchanges globally that permits you to purchase bitcoins using SEPA transfers.

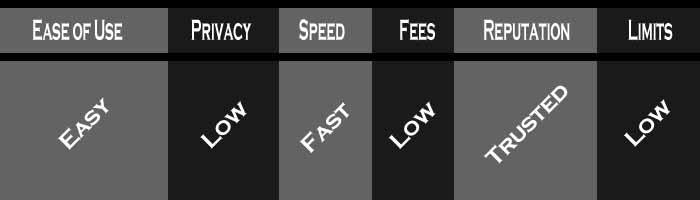

The world’s biggest Bitcoin broker is Coinbase. They serve as a fast and easy way for novice users to buy bitcoins. Coinbase supports clients from over thirty countries which includes the US, Europe (except Germany), Singapore, UK, Australia and Canada.

These customers from the countries mentioned can buy bitcoins using debit card, credit card, SEPA transfer, bank transfer and more.

Get free bitcoins worth €10 or $10 when you purchase more than €100 or $100 worth in this link.

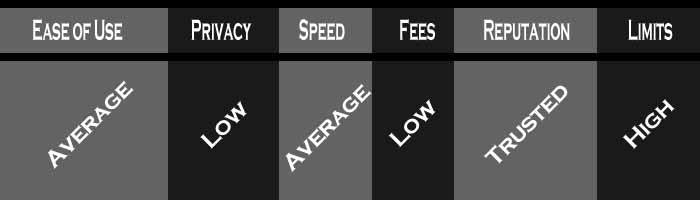

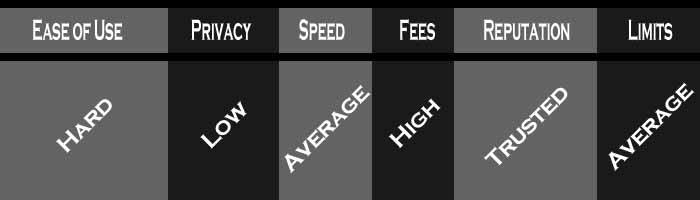

Pros

Cons

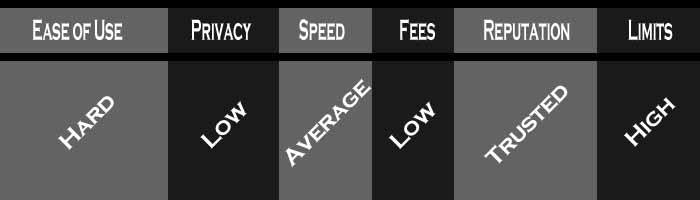

BitPanda is an Austria-based Bitcoin broker.

Their payment limit is high and they have low fees among their wide selection of payment methods.

BitPanda gives customers the choice to purchase bitcoins with debit card, credit card, SOFORT, NETELLER, Skrill, eps, giropay, Online Bank Transfer and SEPA.

This guide will help you learn how to purchase bitcoins on BitPanda by using a credit card.

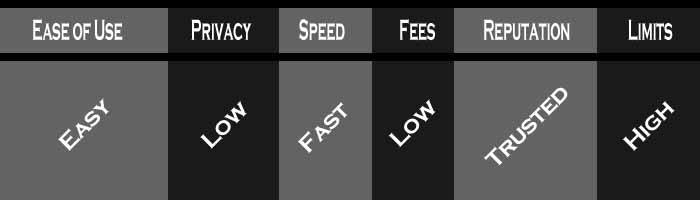

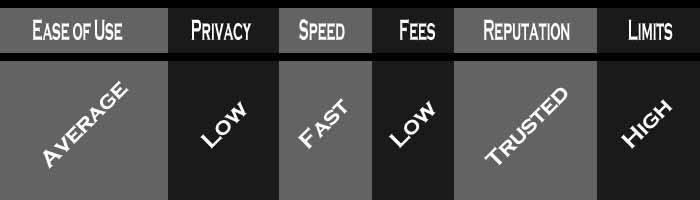

Pros

Cons

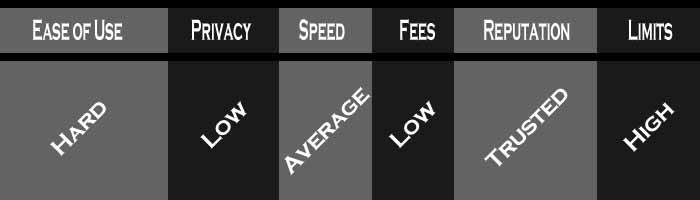

GDAX is Coinbase’s exchange and is the one of the biggest exchanges of Bitcoin in the U.S. Customers can fund accounts using bank wire, SEPA or bank transfer. GDAX offers low fees and good prices but because their user interface is confusing, it may be difficult to use.

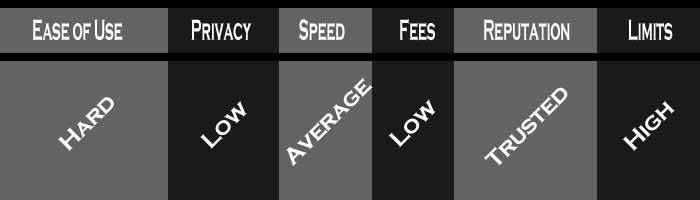

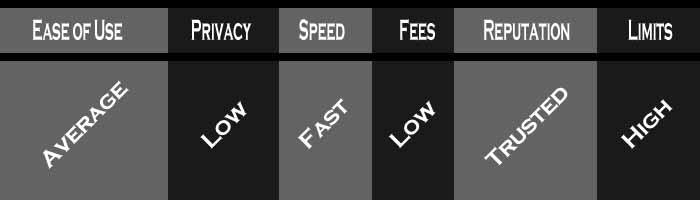

Pros

Cons

CEX.io allows you to purchase bitcoin using a cash, credit card, SEPA transferm AstroPay or ACH bank transfer. Credit card purchases permits you to access immediately your bitcoins.

CEX.io works in Europe, in the U.S. and some South American countries.

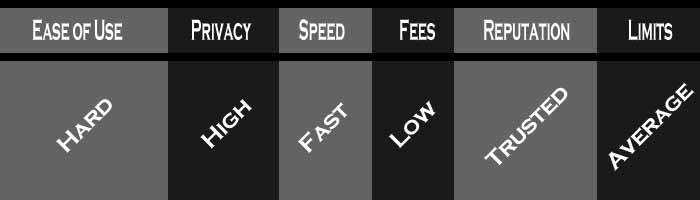

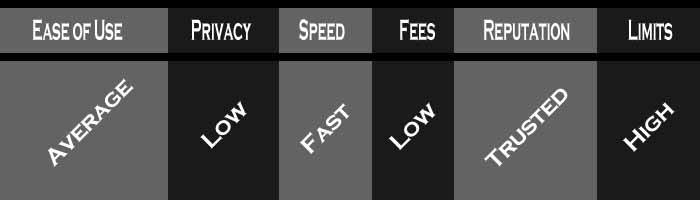

Pros

Cons

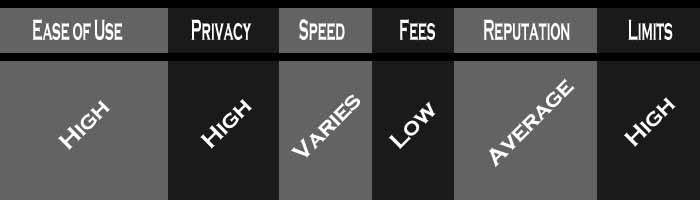

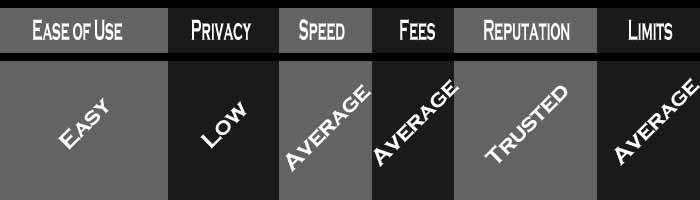

Considered an escrow service, LocalBitcoins assists in matching bitcoin sellers and buyers. The most usual payment method is cash deposit. But, users may endorse trades for any preferred payment methods.

Bitcoin buying through meeting in person facilitated and secured by LocalBitcoins, can be considered most private and one of the quickest ways to purchase bitcoins in whichever country.

Pros

Cons

Bitcoin.de is a dominant peer-to-peer exchange of Bitcoin for Europeans. Users can purchase bitcoin from other users of Bitcoin.de online via SEPA bank transfers

Pros

Cons

Coinfloor is situated in United Kingdom. They operate as a referral service for broker (named Coinfloor Market) as well as a Bitcoin exchange (named Coinfloor Exchange). The exchange service of Coinfloor accepts deposits in EUR, GBP, USD and PLN.

Clients can deposit in the Market through bank transfers in UK and deposit to the exchange through SEPA, bank transfer or SWIFT.

Pros

Cons

Coinfinity is an Austria-based Bitcoin exchange. Clients can purchase bitcoin through SOFORT. It also runs Bitcoin ATMs in Graz and Vienna as well as owns the bitcoinbon voucher service mentioned above.

Pros

Cons

Bity is an ATM operator and Bitcoin exchange, situated in Switzerland. Their five ATMs permits for a speedy first buy and require only phone verification for a buy limit initially of 1,000 CHF or EUR. Their service online accepts online bank transfers, wire transfers and SOFORT.

Pros

Cons

The fourth biggest Bitcoin exchange based in China is LakeBTC. It operates internationally to around forty different countries.

LakeBTC is one of the top 15 global exchanges based average daily trading volume. Customers can deposit via cash, bank wire, Western Union, MoneyGram, OKPay, Perfect Money, PayPal, Payza, Skrill, Neteller, Leupay, CHATS or LakePay, although not all methods are available in all countries.

Pros

Cons

Gatecoin is a regulated Bitcoin and altcoin exchange based in Hong Kong. They accept bank transfers from around 40 different countries. Users can buy bitcoin using HKD, EUR, USD and CNY.

Pros

Cons

Safello is a Bitcoin exchange based in Sweden and fully-registered as a financial institution. It offers a wide range of payment methods - Swish, SEPA, SWIFT, Faster Payments, Bankgiro and iDEAL - to European residents.

Pros

Cons

BitStamp is one of the world's biggest and most surely understood Bitcoin trades. Stores can be made through bank exchange, SEPA exchange, universal bank wire, and now even Visas.

Pros

Cons

Established mid-2013, Kraken is the world's biggest Euro-designated Bitcoin trade, in view of day by day normal exchanging volume. It underpins stores from US, European, Canadian, British, and Japanese clients. Stores can be made by means of bank wire, SEPA, SWIFT, and bank store (Japan as it were).

Pros

Cons

CoinCorner is a Bitcoin trade in view of the Isle of Man. They take into account clients in the UK, Europe, Canada, Australia, and certain African, Asian, and South American nations. CoinCorner clients may buy bitcoins with SEPA, credit/platinum card, GBP bank exchange, and now Netellertoo.

Pros

Cons

Cubits is a Bitcoin trade situated in the United Kingdom. It permits clients in practically every nation other than the United States to buy bitcoins, utilizing an extensive variety of monetary forms and installment techniques. The installment alternatives incorporate SEPA, SWIFT, Mastercards, OKPAY, SOFORT, Skrill, Dotpay, and online bank exchange.

Pros

Cons

itBit is a worldwide Bitcoin trade, authorized with the New York State Department of Financial Services. It additionally works a worldwide OTC exchanging work area, making it simple for clients to purchase substantial sums (100 BTC and up) of bitcoin. It bolsters all US states other than Texas.

Pros

Cons

Anycoin Direct is a Bitcoin specialist situated in the Netherlands which administrations customers crosswise over Europe. Clients can buy bitcoin with SEPA, SOFORT, Giropay, iDEAL, Mybank, Bancontact, and TrustPay.

Pros

Cons

BTC-e is a Bitcoin trade situated in Bulgaria. While its proprietors stay unknown, it's been around for quite a while and is one of the more prominent trades. Not at all like numerous other managed trades, BTC-e has never lost client stores, which builds its notoriety for reliability. Nonetheless, as it's unregulated, its proprietors could conceivably flee with client reserves at whatever time. BTC-e gives off an impression of being dependable, however use with alert and don't leave finances on the trade!

Users can deposit via US bank wire, SEPA, Visa, Mastercard, Liqpaym, unikarta, PerfectMoney, WebCreds, Ukash, and Webmoney.

Pros

Cons

HappyCoins is a Bitcoin trade situated in the Netherlands which administrations clients crosswise over Europe. HappyCoins acknowledges an extensive variety of installment techniques, including numerous moment installment strategies; iDEAL, Bancontact, GiroPay, myBank, Sofort and Interac. It likewise offers SEPA stores for all EU occupants, which take 1 to 3 days to clear.

Pros

Cons

ANXPRO is a Bitcoin trade situated in Hong Kong. It gives you a chance to purchase bitcoins with bank exchange.

Pros

Cons